MARKET UPDATE FOR CALGARY REAL ESTATE IN OCTOBER 2024

This year's Calgary Real Estate Board (CREB) Forecast was issued a few days ago amid tariff uncertainty.

In general, two worlds were pictured: In a tariff-free world, we would see a resumption of moderate appreciation for all property types except apartments (level). In a tariff world, we would have less predictable outcomes, but most likely a recession-led depreciation in apartments and stability in other property types.

Our thoughts are more diverse than CREB's. In a tariff-free world, we expect a 0-5% depreciation of apartments, 0-5% appreciation of townhomes, and 5-15% appreciation of semi & detached homes depending on price range & location. The outcome of a Canadian recession based on a tariff war is very unclear. If energy is heavily included, or the trade war leads to a global recession, global/local oil prices would be significantly impacted, and falls in real estate valuations across the board would be the expectation. Though uncertainty abounds, it seems more likely from the latest tariff f blustering, that Ontario, Quebec & Ontario would be more affected and not global (or local) oil prices so much. In this scenario, interest rates could be cut dramatically, making the impact on the Calgary housing market completely unpredictable (as during covid).

Enough speculation...

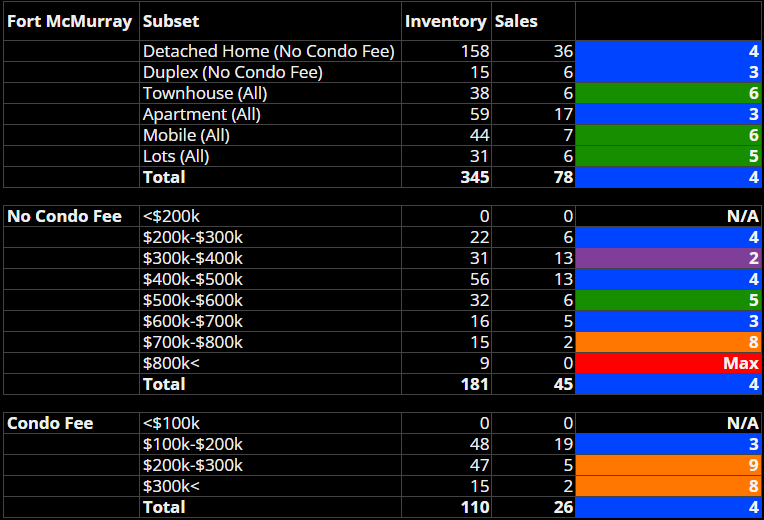

In the stats panel above, you can see that a shortage remains across the board except for apartment-style condominiums, which have continued to balance due to new supply exceeding recent demand. Rents continue to call appreciably.

In the stats, and on the ground, we find the townhome market less jumpy and increasingly balanced (though it remains in a technical seller's market in most price ranges and locations).

Semi-detached & detached sectors remain in a technical seller's market, and we do often see multiple offers around 25% of the time.

This week we sold one detached home in multiples and secured two townhomes (one in multiples, one under threat of multiples). We also secured one semi-detached home in multiples. All of these fell in the price range $340k-$810k.

As you know, if Trumpcertainty subsides (most likely outcome?) demand that has been pent-up due to the expectation of rates continuing to fall, and not because of recent economic uncertainty, we are expecting a strong move-up market into the $800k-$1.5m space). Currently, most activity in the freehold sector (no condo fees) is under $800,000.

It will be interesting to see things play out this year. Our guess (and it is a guess) is that uncertainty will end, and the smarter money will have been accumulating assets in the interim.