MARKET UPDATE FOR CALGARY REAL ESTATE IN MARCH 2024

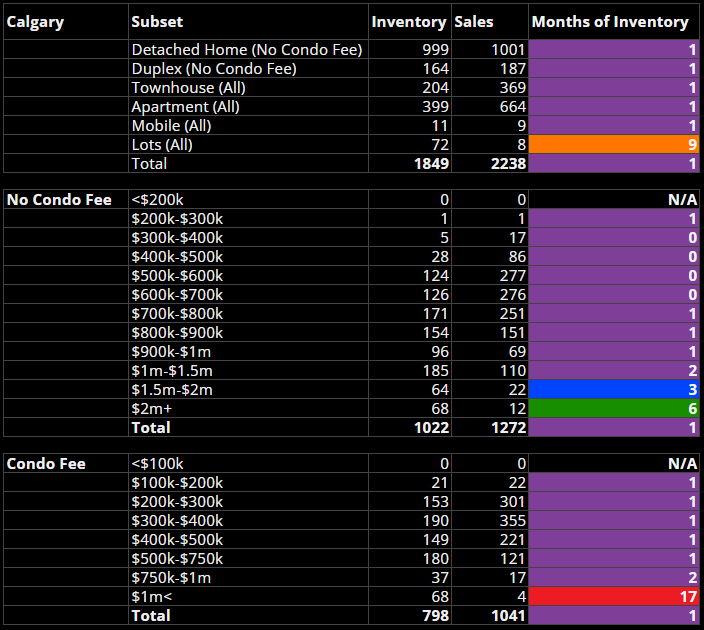

Seller's market conditions prevailed across the board in March (and April, month-to-date). Continuing the trend, entry-level housing types and more affordable geographical areas, saw the greatest imbalances and therefore the strongest price gains.

Price gains: As we entered spring, sales rose, but the percentage increase in new listings did not keep pace. As a result, price gains for different product types rose on paper by 2-3% in March versus an average of 1-2% per month over the last two years.

It is worth noting, that anecdotally, in much of our operations, we are not seeing these kinds of growth rates "on the ground", probably because much of the business we do is not for entry-level products.

One stat that we track at the brokerage (RE/MAX First) is showings per listing (per week) because it is a leading indicator of value growth. It is currently showing the third-highest number in the last three calendar years, with the only two higher values being in Feb 2022.

In the short run (0-6 months) we anticipate continued rapid run-up of values and rents to continue rising, based on the statistics. That is, as long as we don't see global events e.g. recession, significant rate changes, and/or oil price changes. In the long term, we are watching housing policy and policies around migration patterns, as these greatly impact local family formation.

We think we're seeing the continuation of a (slow) rotation of demand into the City Centre, and larger, detached homes. This is usually the next phase of a growth market, as even newer homeowners experience the wealth effect of higher home values.

April 22nd we find out if the council will rubber stamp city-wide rezoning, which on the one hand will marginally increase "missing middle" housing (townhomes), but may also have negative externalities. We think a "donut ring" of communities (not central, not distant suburban) would see most new development, due to their lower per sqft land costs and still relatively connected locations.