MARKET UPDATE FOR CALGARY REAL ESTATE IN August 2024

I took a few days to think about this month's

market report because so much is happening and I want to paint an accurate picture.

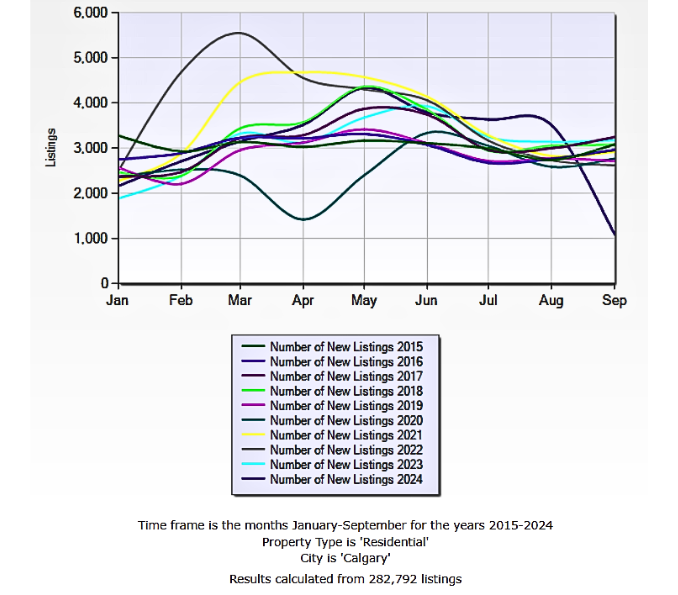

August, was a slow month for sales relative to this time last year. When we zoom out, however, we see it was busy compared to the 10-year average: August was the second busiest August for residential sales, in the last 10 years (after last year).

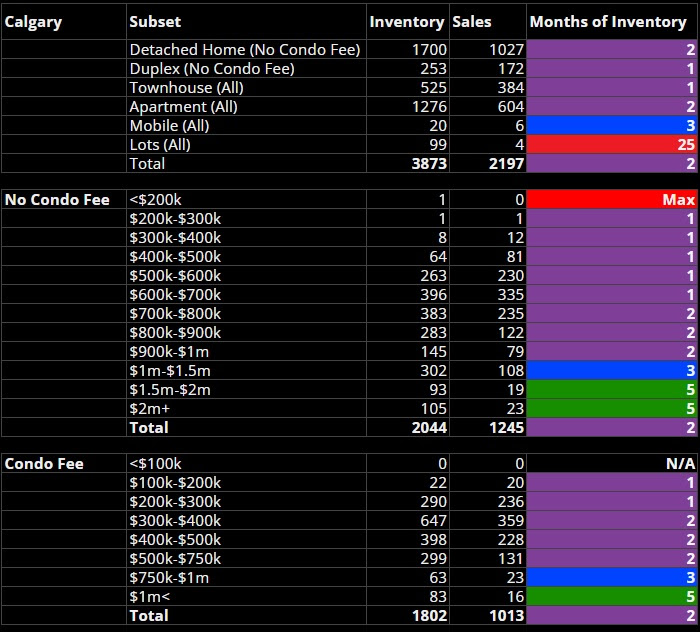

The real story this month (as well as in July and September month-to-date) is a significant increase in the rate of new Calgary residential listings, as shown in the chart below

The important ratios of sellers to buyers place Calgary in a seller's

market.

For anyone curious, I took a quick look at negotiations in August:

What fraction of lower-priced townhomes (<$400k), apartments (<$250k), and detached homes (<$600k) sold for full price or more than full price? The answer? Approximately half.

What fraction of lower-priced townhomes (>$550k), apartments (>400k), and detached homes (>$1m) sold for full price or more than full price? The answer? Approximately a quarter.

This information reaffirms and reminds us that the seller's market continues, but it's certainly a lot more gentle and nuanced than it was this spring. For example, the sale premiums over the list price have also fallen significantly. As a result, prices were broadly stable in August.

What next?

Sellers are finally responding to the profit signal of higher prices. Inventory is building despite strong demand. It stands to reason that if nothing changes, balance will occur at some point in the future. "If nothing changes" is very important here...

Are more sellers listing only because of higher recent prices, or are they doing so because of high variable or renewal interest rates, too? As you may be aware, central bank rates are falling fast in Canada, and soon in the US (which is important).

Holding other things equal, falling rates, will reduce supply and spur further demand. But how soon will that kick in? According to this old favorite research paper, it could take some time. Commentators are also watching the global economy with unease - if a global recession ensues, we Albertans know how that impacts oil/jobs. On the flip side, the themes driving the recent housing shortage could return to dominate, in which case this moment is a good one to invest or move up. I wish I knew!

In summary, our outlook has changed from seller's market to seller's/uncertain, and we're already looking forward to more data next month.