MARKET UPDATE FOR CALGARY REAL ESTATE IN MARCH 2025

Q1 in Review

The quarter finished slightly weaker than it began.

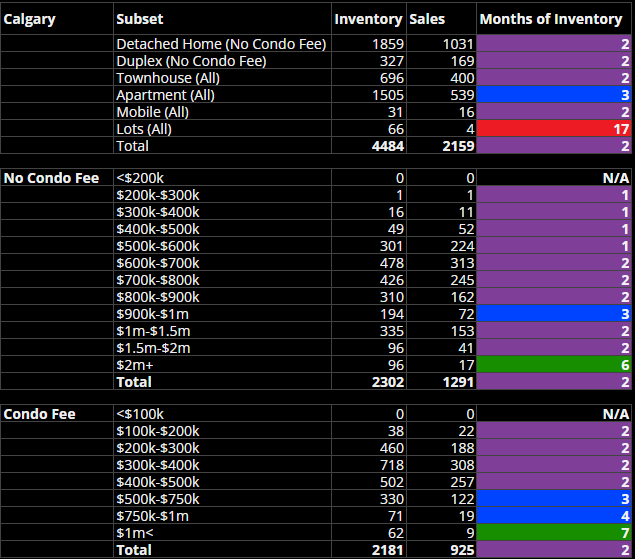

Seasonally adjusted demand fell this month versus last month due to tariff uncertainty, but the effect of this uncertainty was not uniform:

- Demand came off for apartments & more expensive suburban homes ($900k/$1m+)

- Demand remained strong for most/all other property types

Importantly, the rate of new listings entering the market has not continued to rise as much as compared to this time last year. The rate of new listings can be described as high and stable. This is especially true of apartments.

Prices remained broadly stable across all property types, with some growth in some detached home values (mainly just seasonal) and some declines in the values of apartments - particularly in outlying areas busy with new development. Please note: Price action is very location and price range-specific. In this market, surprises happen.

Technically, we are in a seller's market, which is easy to forget with all the uncertainty around. Just checking area sales from the last day, a full 30 out of 105 listings sold did so for full price or more than full price (many of which will have done so with more than one offer). The mood out there, however, is holding back price growth.

Q2 Outlook

*5th April Edit: The following is based on there not being an extended stock market/oil market rout.*

The only certainty is that variable rates are going to continue to fall (they are now reaching the neutral zone and will soon enter the expansionary zone). This is taking the heat off early COVID homebuyers, who are soon to renew, as well as investors who have been under pressure from falling rents (down 10% YoY). I suppose another certainty is that Canada remains in a long-term housing crisis.

We like to give strong advice and are happy to share our thoughts, but I think themes for self-reflection this Q2 might be:

- Do you think this uncertainty will last & turn into a global recession deeply affecting stock prices & the oil price? Or do you think it will pass for Canada and specifically for Alberta?

- Who will win the Federal election, and what will happen to he supply of homes and people, if anything?

- How might changes in the US affect the flow of people and capital to and within Canada.

- Climate change policy and pipeline politics? Is change afoot?

Anecdotally, we are fortunate to have pretty full pipelines of buyers and sellers in the Calgary area, people whom we are always excited to help. The sellers are due to come to the market steadily, but we're not sure when the buyers will truly awaken. I suspect that it will occur after the federal election is over, regardless of who wins, and when rates enter the expansionary zone. My outlook: Short-term neutral, medium-term strong, long-term strong. If it does go that way, I think the biggest change will be in the higher price ranges once confidence returns and more people look at "moving up".

Please reach out to us for tailored pricing & advice!